¿Será inestable el precio del lingote de aluminio después del lanzamiento estratégico del mercado petrolero estadounidense?

U.S. officials: if necessary, the U.S. prepares to release strategic oil%2 6nbsp ;reserves againChina News Service, Noviembre 30 2021 Según to a comprehensive report , Amos Hawkstein, senior adviser on&n bsp;energy security issues of the US& nbsp;Estado Departamento, said on the 29th that in order to adjust oil&nb sp;mercado prices, if necesario, the Biden&nbs p;administration is ready to release its ;own strategic oil reserves aotra vez.

Según to US media reports, on related issues in the TV&n bsp;programa , Horkstein rerespondió: "I will definitivamente do this. This is a tool that we can use , and it can be used aotra vez."

Según to el ruso Satélite Red, el el llamado strategico %3hervir ;reserve is one of the efectivo ways to deal con a corto plazo oil ;supply shocks (interrupciones a gran escala %3 or ). It serves the national energy ;security, with the Purpose of ensuring the continuo supply of crudo oil , and at the same time has the function of stabilizing abnormal fluctua ciones ;in doméstico oil precios.

Recientemente, the price of gasoline in the United States has risen to % 3ba ssiete años high, and doméstico llamadas for the release of strategic oil% 26nbsp;reserves to estabilize oil prices have continued to rise. U.S. President%2 6nbsp% 3bBiden also recently urged the Federal Comercio Comisión to lanunch an ininvestigación% 26nbsp;into% 26nbsp;the possible illegal activities of U.S. oil and gas companies that ;tener causado gasolina precios to continuar to rise.

The White House announced on the 23rd that the U.S. Depart mento% 26nbsp;of Energía will liberación 50 millones barriles of crudo %3hervir de&nb sp;the % 3bStrategic Petroleum Reserve to alleviate the mismatch between oil supply and % 3bdemand and% 26nbsp;reduce oil prices cuando the economy recovers from the new crown %3 bepidemia.

In this regard, foreign media analyzed that the move by& nbsp;el United Estados is "una escasez de drop in the bucket for solve the current oil ." Después a brief drop in international oil prices on the 23rd,&nb sp;the intraday turned from black to red: West Texas Intermedio crudo oil% 26nbsp;rose more que 2% to US$78.18 per barrel; Brent crudo oil&n bsp;se disparó more que 3% to US$81.47 per barrel. Back to the alto% 26nbsp;$81 marca.

Analistas puntó out that in the long run, the release%2 6nbsp;of strategic oil reserves cannot solve the fundamental problem. Even if the&nb sp;precio% 26nbsp;drops brevemente, it cannot be maintained for a long time. The %3hervir lanzado de the strategic reserves is very limited. The 600 million&n bsp;barriles% 26nbsp;of oil reserves in the United States are only enough for the%2 6nbsp% 3bUnited States for one month; the 50 millones barrels released is equi valencia % 3bto sobre 8% of the 600 millones barriles of rereservas, que&n bsp;is% 26nbsp;two and a half days in the United States. Demand is the% 26nbsp ;12 horas consumo in el mundo.

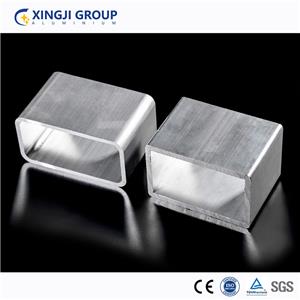

Si el mercado del petróleo se libera nuevamente , significa que la siguiente etapa del perfil del precio del aluminio será inestable ,las fuentes de energía todavía son necesarias para confirmar y la ventana y puerta de aluminio como el producto estable de la casa , será empujar a la venta nuevamente .

Espero que el mercado estadounidense no traiga demasiados problemas financieros para resistir el apoyo normal .